Imagine a world where sending money across borders is as easy as sending an email, where financial transactions are transparent and secure, and where access to financial services is available to everyone, regardless of their location or socioeconomic status. This isn't just a futuristic fantasy; it's a vision rapidly becoming reality thanks to the transformative power of blockchain technology.

Traditional financial systems often present hurdles. Think about the delays and fees associated with international money transfers, the lack of transparency in some financial dealings, and the exclusion of billions of people from basic banking services. These inefficiencies and inequalities create real challenges for individuals and businesses alike.

Blockchain is revolutionizing digital finance and payments by offering a decentralized, secure, and transparent platform for transactions. It eliminates the need for intermediaries, reduces costs, increases efficiency, and enhances security. This technology is paving the way for a more inclusive and accessible financial future for all.

In essence, blockchain's impact boils down to: increased transparency through immutable records, enhanced security via cryptography, reduced costs by cutting out middlemen, and greater efficiency thanks to faster transaction times. These advancements are reshaping everything from cross-border payments and supply chain finance to digital identity management and decentralized lending, making finance more democratic and accessible.

Enhanced Security and Transparency

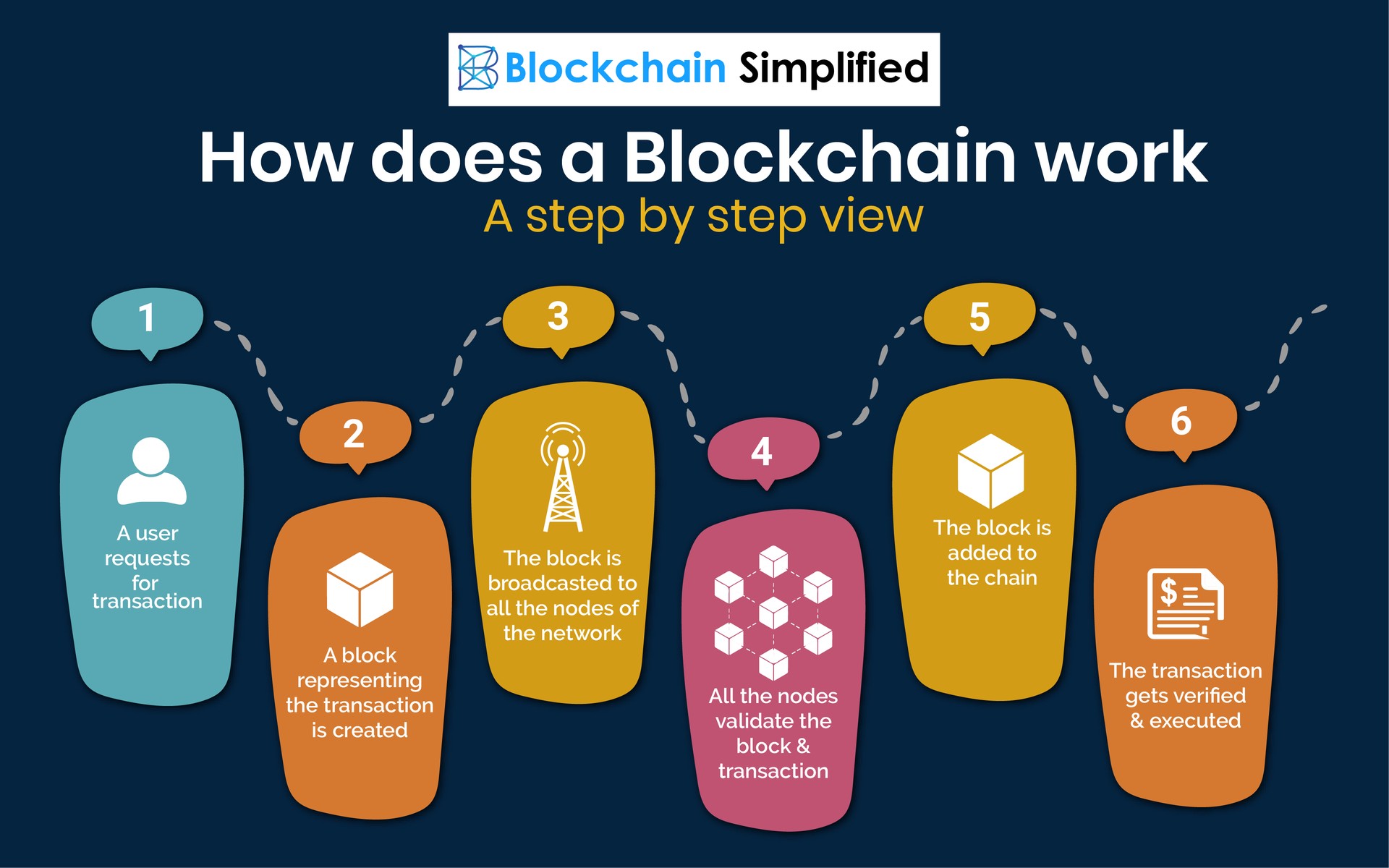

I remember the first time I heard about blockchain; I was skeptical. It sounded like another tech buzzword with little practical application. However, the more I learned, the more I realized the potential it held, particularly in addressing the lack of trust and transparency that often plagues the financial world. One of the biggest advantages of blockchain is its inherent security. Each transaction is recorded in a "block" that is linked to the previous block, forming a chain that is nearly impossible to tamper with. This immutability ensures that every transaction is permanently recorded and verifiable. This increased transparency helps to reduce fraud and build trust among participants. This is a stark contrast to traditional systems, where transactions are often opaque and susceptible to manipulation. For example, in supply chain finance, blockchain can track goods from origin to delivery, ensuring authenticity and preventing counterfeiting. Similarly, in digital identity management, blockchain can provide a secure and verifiable way to prove identity, reducing the risk of identity theft and fraud. Blockchain's cryptographic security ensures that transactions are protected from unauthorized access and manipulation. In digital payments, this translates to a reduced risk of fraud and chargebacks, making online transactions safer for both merchants and consumers. The decentralized nature of blockchain also means that there is no single point of failure, making it more resilient to cyberattacks.

Faster and Cheaper Transactions

Traditional financial transactions, especially cross-border payments, can be notoriously slow and expensive. They often involve multiple intermediaries, each taking a cut of the transaction and adding to the overall processing time. Blockchain offers a solution by enabling peer-to-peer transactions that bypass these intermediaries. This results in significantly faster and cheaper transactions. For example, a cross-border payment that might take days and cost a significant percentage of the transaction amount through traditional channels can be completed in minutes or even seconds with blockchain, at a fraction of the cost. This has significant implications for businesses operating globally, as it can reduce transaction costs and improve cash flow. Blockchain technology also has the potential to revolutionize microfinance by making it easier and cheaper to send small amounts of money to people in developing countries. This can provide access to financial services for those who are currently excluded from the traditional banking system. Furthermore, the increased efficiency of blockchain transactions can lead to reduced operational costs for financial institutions, allowing them to offer more competitive services and products to their customers. By streamlining processes and eliminating the need for intermediaries, blockchain is transforming the landscape of digital finance and payments.

Decentralized Finance (De Fi)

The history of finance is rife with centralized control, often leading to imbalances and limited access for many. Myths of impenetrable fortresses guarding financial power have persisted. Blockchain is challenging this narrative by enabling decentralized finance (De Fi). De Fi aims to create a more open, transparent, and accessible financial system built on blockchain technology. It offers a range of financial services, such as lending, borrowing, trading, and insurance, without the need for traditional intermediaries like banks and brokers. De Fi applications are typically built on smart contracts, which are self-executing agreements written in code. These smart contracts automate the execution of financial transactions, eliminating the need for human intervention and reducing the risk of fraud and manipulation. One of the key benefits of De Fi is its accessibility. Anyone with an internet connection can participate in De Fi, regardless of their location or credit score. This has the potential to empower individuals and communities that are currently underserved by the traditional financial system. Furthermore, De Fi offers greater transparency and control over financial assets. Users can track their transactions in real-time and have full control over their funds. As De Fi continues to evolve, it has the potential to disrupt the traditional financial system and create a more inclusive and equitable financial future.

Smart Contracts and Automation

One of the less talked about aspects of blockchain is its capacity for automating financial processes through smart contracts. Smart contracts are self-executing agreements written into the blockchain's code. They automatically enforce the terms of an agreement when certain conditions are met, without the need for human intervention. This can significantly streamline financial processes and reduce the risk of errors and fraud. For example, in supply chain finance, a smart contract can automatically release payment to a supplier once the goods have been delivered and verified. This eliminates the need for manual invoice processing and reduces the risk of disputes. Similarly, in insurance, a smart contract can automatically pay out a claim once the covered event has occurred, such as a flight delay or a natural disaster. This speeds up the claims process and reduces administrative costs. Smart contracts can also be used to automate compliance with regulatory requirements. For example, a smart contract can automatically verify the identity of a customer and ensure that they are not on any sanctions lists. This can help financial institutions to comply with anti-money laundering (AML) and know your customer (KYC) regulations. The automation capabilities of smart contracts have the potential to transform a wide range of financial processes, making them more efficient, transparent, and secure.

The Future of Digital Payments with Blockchain

If you're looking for guidance on how blockchain will reshape digital payments, consider this: focus on solutions that prioritize user experience, security, and regulatory compliance. The future of digital payments powered by blockchain is not just about technological advancements; it's about creating a seamless and secure experience for users while adhering to the evolving regulatory landscape. Look for platforms that offer user-friendly interfaces, robust security measures, and compliance with relevant regulations. Furthermore, consider the scalability and interoperability of the blockchain solution. It should be able to handle a large volume of transactions and integrate with existing payment systems. The future of digital payments also involves the integration of blockchain with other emerging technologies, such as artificial intelligence and the Internet of Things (Io T). This can enable new and innovative payment solutions, such as automated payments for Io T devices and personalized payment experiences powered by AI. As blockchain technology continues to mature, it is important to stay informed about the latest developments and trends. This will help you to make informed decisions about how to leverage blockchain to improve your digital payment processes.

The Role of Cryptocurrency

Cryptocurrencies are often seen as the primary application of blockchain technology, and they play a significant role in the transformation of digital finance and payments. Cryptocurrencies offer a decentralized and borderless way to transfer value, without the need for traditional intermediaries. This can be particularly useful for cross-border payments, where traditional systems can be slow and expensive. Cryptocurrencies also offer a potential hedge against inflation and currency devaluation. In countries with unstable economies, cryptocurrencies can provide a store of value that is not subject to government control. However, cryptocurrencies also come with risks, such as price volatility and regulatory uncertainty. It is important to understand these risks before investing in cryptocurrencies. Furthermore, the use of cryptocurrencies in illegal activities, such as money laundering and terrorism financing, has raised concerns among regulators. As a result, many countries are implementing regulations to govern the use of cryptocurrencies. Despite these challenges, cryptocurrencies have the potential to play a significant role in the future of digital finance and payments. As the technology matures and regulatory frameworks are established, cryptocurrencies could become a mainstream payment method.

Tips for Navigating the Blockchain Revolution

Navigating this new landscape requires a strategic approach. First, educate yourself. Understand the fundamental principles of blockchain technology and its potential applications in finance and payments. There are numerous online resources, courses, and events that can help you to gain a solid understanding of blockchain. Second, identify the specific challenges that blockchain can address in your organization or industry. This will help you to focus your efforts and prioritize the most promising applications. Third, start small. Begin with pilot projects to test the feasibility and effectiveness of blockchain solutions. This will allow you to learn from your experiences and refine your approach before making a large-scale investment. Fourth, collaborate with other organizations and experts in the blockchain space. This can help you to accelerate your learning and avoid common pitfalls. Finally, stay informed about the latest developments and trends in the blockchain industry. The technology is evolving rapidly, and it is important to stay up-to-date on the latest advancements and regulations. By following these tips, you can effectively navigate the blockchain revolution and leverage its potential to transform your digital finance and payment processes.

Addressing Scalability and Interoperability

One of the major hurdles for widespread blockchain adoption is scalability. Many blockchain networks struggle to handle a large volume of transactions, leading to slow processing times and high transaction fees. Various solutions are being developed to address this challenge, such as layer-2 scaling solutions and sharding. Layer-2 solutions build on top of existing blockchain networks to process transactions off-chain, while sharding divides the blockchain into smaller, more manageable pieces. Another challenge is interoperability. Different blockchain networks often operate in silos, making it difficult to transfer assets and data between them. This limits the potential for collaboration and innovation. Interoperability solutions, such as cross-chain bridges and atomic swaps, are being developed to address this challenge. These solutions enable different blockchain networks to communicate with each other and exchange value. As scalability and interoperability solutions mature, they will pave the way for greater blockchain adoption and innovation in digital finance and payments.

Fun Facts About Blockchain and Finance

Did you know that the first real-world transaction using Bitcoin was for two pizzas, costing 10,000 BTC? That's now worth hundreds of millions of dollars! Or that some banks are exploring blockchain to streamline their internal processes and reduce operational costs? The adoption of blockchain in the financial sector is not just about cryptocurrencies; it's about improving efficiency, transparency, and security across the board. Another fun fact is that some countries are exploring the possibility of issuing their own central bank digital currencies (CBDCs) on blockchain. This could potentially revolutionize the way money is issued and managed. Furthermore, blockchain is being used to create new and innovative financial products, such as decentralized lending platforms and prediction markets. The possibilities are endless! As blockchain technology continues to evolve, it is likely to uncover even more surprising and exciting applications in the world of finance.

How to Get Involved in the Blockchain Revolution

Interested in being a part of this transformative journey? There are numerous ways to get involved. You can start by learning more about blockchain technology and its applications. There are many online resources, courses, and events that can help you to gain a solid understanding of blockchain. You can also explore different blockchain platforms and tools to see how they work. Furthermore, you can participate in blockchain communities and forums to connect with other enthusiasts and experts. If you have technical skills, you can contribute to open-source blockchain projects or develop your own blockchain applications. If you have business skills, you can explore how blockchain can be used to improve your organization's processes or create new business models. You can also invest in blockchain companies or cryptocurrencies. However, it is important to do your research and understand the risks involved before investing. By getting involved in the blockchain revolution, you can contribute to the development of a more open, transparent, and accessible financial system.

What If Blockchain Becomes the Standard?

Imagine a future where blockchain underpins the entire financial system. Transactions would be faster, cheaper, and more secure. Financial services would be accessible to everyone, regardless of their location or socioeconomic status. Fraud and corruption would be significantly reduced. The financial system would be more transparent and accountable. This future is not just a pipe dream; it is a real possibility. As blockchain technology continues to mature and regulatory frameworks are established, it could become the standard for digital finance and payments. However, there are also potential challenges to consider. For example, concerns about privacy and data security would need to be addressed. Furthermore, the transition to a blockchain-based financial system could be disruptive and require significant investment. Despite these challenges, the potential benefits of a blockchain-based financial system are enormous. It could create a more efficient, transparent, and equitable financial future for all.

Top 5 Ways Blockchain is Changing Finance

Here's a quick listicle summarizing the key ways blockchain is revolutionizing digital finance:

- Cross-Border Payments: Faster, cheaper, and more transparent international money transfers.

- Decentralized Finance (De Fi): Access to financial services without intermediaries, empowering individuals and communities.

- Supply Chain Finance: Enhanced transparency and traceability of goods, reducing fraud and improving efficiency.

- Digital Identity Management: Secure and verifiable digital identities, reducing the risk of identity theft and fraud.

- Smart Contracts: Automated and self-executing agreements, streamlining financial processes and reducing errors.

Question and Answer

Q: Is blockchain technology secure enough for financial transactions?

A: Yes, blockchain's cryptographic security and decentralized nature make it highly secure. Each transaction is recorded in a block that is linked to the previous block, forming a chain that is nearly impossible to tamper with. This immutability ensures that every transaction is permanently recorded and verifiable.

Q: How does blockchain reduce the cost of financial transactions?

A: Blockchain eliminates the need for intermediaries, such as banks and payment processors, which charge fees for their services. By enabling peer-to-peer transactions, blockchain reduces transaction costs significantly.

Q: What is De Fi, and how is it related to blockchain?

A: De Fi stands for Decentralized Finance. It refers to a range of financial services, such as lending, borrowing, and trading, that are built on blockchain technology. De Fi aims to create a more open, transparent, and accessible financial system.

Q: What are the main challenges to widespread blockchain adoption in finance?

A: The main challenges include scalability, interoperability, regulatory uncertainty, and concerns about privacy and data security. As these challenges are addressed, blockchain adoption in finance is expected to increase.

Conclusion of How Blockchain is Transforming the Future of Digital Finance and Payments

Blockchain technology is poised to reshape the future of digital finance and payments, offering solutions to long-standing issues such as high costs, lack of transparency, and limited access. While challenges remain, the potential benefits are undeniable. By embracing this innovative technology, we can create a more inclusive, efficient, and secure financial system for everyone.