Imagine a world where blockchain networks talk seamlessly to each other, where moving assets between different chains is as easy as sending an email. This isn't just a dream; it's the future we're building towards, a future powered by interoperability between Layer 1 and Layer 2 networks.

Today, the blockchain landscape often feels like a collection of isolated islands. Moving assets and data between these islands can be cumbersome, expensive, and sometimes even risky. This fragmentation limits the potential of decentralized applications and hinders broader adoption.

This article explores the evolving landscape of interoperability between Layer 1 and Layer 2 networks. We'll delve into the technologies that are making cross-chain communication a reality, the challenges that remain, and the exciting possibilities that lie ahead.

This exploration highlights the significance of cross-chain communication, bridges, atomic swaps, and the overall impact of interoperability on scalability and user experience within the blockchain ecosystem. It will navigate the complexities and outline the innovations driving a more connected and efficient decentralized future.

The Promise of Cross-Chain Communication

Cross-chain communication holds immense potential for the blockchain ecosystem. I remember when I first tried to bridge some tokens from Ethereum to Polygon. The gas fees on Ethereum were outrageous, and the whole process felt incredibly clunky. It took multiple confirmations, and I was constantly worried about losing my funds in transit. It was a stark reminder of the limitations we currently face.

The ability to seamlessly transfer assets and data between different blockchains unlocks a new level of composability and efficiency. Imagine a De Fi application that can leverage the speed and low fees of a Layer 2 network like Arbitrum while still benefiting from the security and liquidity of Ethereum's Layer 1. This kind of interoperability can foster innovation and drive mass adoption by making decentralized applications more user-friendly and accessible.

Furthermore, cross-chain communication can enable new use cases, such as cross-chain lending, borrowing, and staking. Users could potentially collateralize assets on one chain and borrow against them on another, opening up new avenues for financial innovation. The potential benefits are vast, and the industry is actively developing solutions to overcome the existing hurdles.

Understanding Layer 1 and Layer 2 Networks

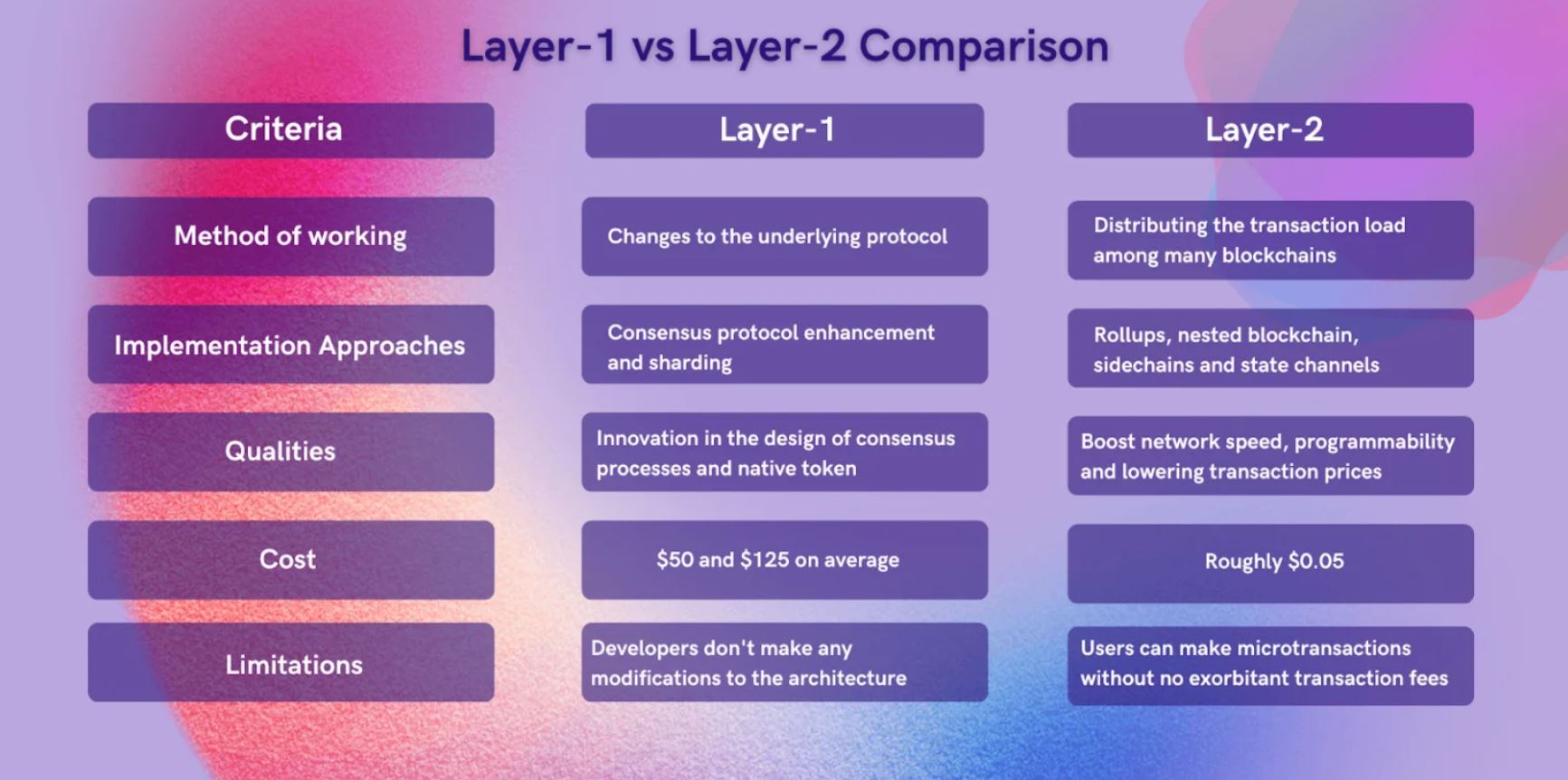

Layer 1 networks, like Bitcoin and Ethereum, are the foundational blockchains that provide the base layer security and consensus mechanisms. However, they often struggle with scalability, leading to high transaction fees and slow confirmation times. Layer 2 networks, on the other hand, are built on top of Layer 1 networks to improve scalability and efficiency.

Think of Layer 1 as the main highway and Layer 2 as the express lanes that run alongside it. Layer 2 solutions, such as Optimistic Rollups and ZK-Rollups, process transactions off-chain and then periodically submit bundled transaction data to the Layer 1 for verification. This significantly reduces the load on the Layer 1, allowing for faster and cheaper transactions. However, the effectiveness of Layer 2 solutions hinges on their ability to seamlessly interact with the underlying Layer 1 network.

Interoperability between Layer 1 and Layer 2 networks is crucial for unlocking the full potential of both. It allows users to move assets and data between the main chain and the scaling solutions without friction, creating a more cohesive and user-friendly experience. Without seamless interoperability, Layer 2 solutions risk becoming isolated silos, hindering their ability to contribute to the overall growth and adoption of the blockchain ecosystem.

The History and Myth of Interoperability

The dream of interoperability is as old as blockchain itself. Early on, the focus was primarily on connecting different Layer 1 blockchains, like Bitcoin and Ethereum. The idea was to create a "blockchain of blockchains" where assets and data could flow freely between different networks.

One of the early myths surrounding interoperability was that a single "universal bridge" could connect all blockchains. However, as the ecosystem has matured, it has become clear that a more nuanced approach is needed. Different blockchains have different security models, consensus mechanisms, and governance structures, making it challenging to create a one-size-fits-all solution.

The history of interoperability is filled with both successes and setbacks. Early attempts at cross-chain bridges were often vulnerable to hacks and exploits, highlighting the importance of robust security measures. However, recent advancements in bridging technology, such as optimistic bridges and ZK-bridges, have significantly improved the security and efficiency of cross-chain communication. As the technology continues to evolve, the dream of a truly interconnected blockchain ecosystem is becoming increasingly within reach.

The Hidden Secrets of Secure Bridges

The security of bridges is paramount for successful interoperability. A compromised bridge can result in significant financial losses and damage the reputation of the entire ecosystem. The hidden secret to building secure bridges lies in a multi-layered approach that addresses various potential attack vectors.

One key aspect is the use of cryptographic techniques, such as multi-signature wallets and threshold signature schemes, to protect the bridge's funds. These techniques ensure that no single entity can unilaterally control the bridge's assets. Another important factor is the implementation of robust monitoring and auditing mechanisms to detect and respond to suspicious activity.

Furthermore, bridges should be designed with fault tolerance in mind. This means that the bridge should be able to continue operating even if some of its components fail. One way to achieve this is to use decentralized consensus mechanisms to validate cross-chain transactions. By distributing the responsibility for validating transactions across multiple nodes, the bridge becomes more resilient to attacks and censorship.

Recommendations for Navigating the Interoperable Future

Navigating the increasingly complex landscape of interoperability requires careful consideration and informed decision-making. One key recommendation is to thoroughly research and understand the security trade-offs of different bridging solutions. Not all bridges are created equal, and some may be more vulnerable to attacks than others.

Another important recommendation is to diversify your exposure to different blockchains and Layer 2 networks. By spreading your assets across multiple chains, you can reduce your risk in case one network experiences a security breach or technical issue. Additionally, it's important to stay up-to-date on the latest developments in interoperability technology.

The blockchain space is constantly evolving, and new solutions are emerging all the time. By staying informed, you can make better decisions about which bridging solutions to use and how to best leverage the benefits of interoperability. Finally, consider using De Fi aggregators that abstract away the complexity of interacting with multiple chains and protocols. These aggregators can simplify the process of finding the best yields and managing your assets across different networks.

The Role of Atomic Swaps

Atomic swaps represent a trustless method for exchanging cryptocurrencies directly between two parties without the need for a central intermediary. They are a vital component of the interoperability landscape as they enable direct peer-to-peer transactions across different blockchains.

The key to atomic swaps lies in the use of Hashed Time Lock Contracts (HTLCs). These contracts ensure that the exchange only occurs if both parties fulfill their obligations within a specific timeframe. If either party fails to do so, the transaction is automatically canceled, and both parties retain their original funds. This mechanism eliminates the risk of one party receiving the funds without delivering the agreed-upon cryptocurrency.

While atomic swaps offer a promising solution for cross-chain transactions, they also have some limitations. They typically require both parties to be online simultaneously to execute the swap, which can be inconvenient. Additionally, atomic swaps can be more complex to implement than traditional centralized exchanges. However, ongoing research and development are addressing these limitations, making atomic swaps a valuable tool for building a more decentralized and interoperable blockchain ecosystem.

Tips for Securely Bridging Assets

Bridging assets between different chains can be a rewarding but also risky endeavor. Here are a few tips to help you bridge your assets safely and securely. First and foremost, always double-check the bridge's address and the destination chain before initiating a transaction. A simple mistake can result in irreversible losses.

Secondly, use reputable and well-audited bridges. Look for bridges that have undergone security audits by reputable firms and that have a strong track record of security. Avoid using bridges that are new or have a history of security vulnerabilities. Thirdly, start with small amounts. Before bridging large sums of money, test the bridge with a small transaction to ensure that everything works as expected.

Fourthly, be aware of the risks of impermanent loss. Some bridges use liquidity pools to facilitate cross-chain transactions. If you provide liquidity to these pools, you may be exposed to impermanent loss, which can occur when the relative prices of the assets in the pool change. Finally, keep your private keys safe. Never share your private keys with anyone, and always store them in a secure location.

The Impact on Decentralized Finance (De Fi)

The interoperability between Layer 1 and Layer 2 networks is poised to revolutionize the Decentralized Finance (De Fi) landscape. By enabling seamless cross-chain communication, De Fi applications can access a wider range of assets and users, leading to increased liquidity and innovation.

Imagine a De Fi platform that allows users to collateralize their Bitcoin holdings on the Bitcoin blockchain and borrow stablecoins on Ethereum's Layer 2 network. This kind of cross-chain functionality would unlock new opportunities for yield generation and capital efficiency. Interoperability also enables the creation of more complex and sophisticated De Fi products.

For example, a cross-chain derivatives platform could allow users to trade derivatives contracts that are based on assets from different blockchains. This would provide traders with greater flexibility and access to a wider range of investment opportunities. However, the increased complexity of cross-chain De Fi applications also comes with increased risks. Developers need to carefully consider the security implications of cross-chain communication and implement robust safeguards to protect users' funds.

Fun Facts About Cross-Chain Technology

Did you know that the first cross-chain transaction was actually an atomic swap between Bitcoin and Litecoin? This groundbreaking event demonstrated the feasibility of exchanging cryptocurrencies directly between two different blockchains without the need for a centralized intermediary. Another fun fact is that some bridges use "light clients" to verify cross-chain transactions.

Light clients are simplified versions of full blockchain nodes that can verify transactions without downloading the entire blockchain. This makes it possible to build more efficient and scalable bridges. Interestingly, the term "bridge" in the context of blockchain technology is inspired by the concept of bridges in traditional engineering, which are used to connect two separate landmasses.

Similarly, blockchain bridges connect two separate blockchains, allowing for the transfer of assets and data between them. Another intriguing fact is that some bridges use "oracles" to provide real-world data to smart contracts on different blockchains. Oracles are external data feeds that provide information such as price feeds, weather data, and sports scores. This allows smart contracts to interact with the real world and make decisions based on real-world events.

How to Evaluate a Cross-Chain Bridge

Evaluating a cross-chain bridge involves considering several factors. Security is paramount, so research the bridge's security model and audit history. Look for bridges with transparent security measures, such as multi-signature wallets, threshold signature schemes, and bug bounty programs.

Consider the bridge's efficiency in terms of transaction speed and fees. Some bridges may be faster and cheaper than others, depending on the underlying technology. Also, assess the bridge's level of decentralization. A more decentralized bridge is generally more resistant to censorship and attacks.

Finally, evaluate the bridge's usability and user experience. A good bridge should be easy to use and provide clear instructions on how to transfer assets between chains. By carefully evaluating these factors, you can choose a cross-chain bridge that meets your needs and provides a secure and efficient way to move assets between different blockchains.

What if Interoperability Fails?

If interoperability fails to materialize, the blockchain ecosystem risks becoming fragmented and inefficient. Isolated blockchains would struggle to attract users and developers, hindering innovation and adoption. The lack of seamless cross-chain communication would limit the composability of De Fi applications and make it difficult for users to manage their assets across different chains.

Furthermore, a failure of interoperability could lead to increased centralization. Users might be forced to rely on centralized exchanges to move assets between chains, which would undermine the decentralized nature of blockchain technology. In a worst-case scenario, the blockchain ecosystem could devolve into a collection of competing silos, with limited interaction and collaboration.

However, given the significant investments and ongoing research in interoperability technology, this scenario seems unlikely. The industry is actively working to overcome the challenges of cross-chain communication and build a more interconnected and efficient blockchain ecosystem.

Top 5 Benefits of Layer 1 and Layer 2 Interoperability

Here's a listicle highlighting the top 5 benefits of Layer 1 and Layer 2 interoperability. First, enhanced scalability: By enabling seamless communication between Layer 1 and Layer 2 networks, interoperability helps to alleviate congestion on the main chain and improve overall scalability.

Second, lower transaction fees: Layer 2 networks typically offer lower transaction fees than Layer 1 networks. Interoperability allows users to take advantage of these lower fees without sacrificing security. Third, increased composability: Interoperability enables De Fi applications to access a wider range of assets and users, leading to increased composability and innovation.

Fourth, improved user experience: Interoperability simplifies the process of moving assets between different chains, creating a more user-friendly experience. Fifth, greater capital efficiency: Interoperability allows users to deploy their capital more efficiently by accessing lending, borrowing, and staking opportunities across multiple chains.

Question and Answer About The Future of Interoperability Between Layer 1 & Layer 2 Networks

Q: What are the main challenges to achieving full interoperability between Layer 1 and Layer 2 networks?

A: The main challenges include ensuring security across different bridging solutions, standardizing communication protocols, and managing the complexity of cross-chain transactions.

Q: What are the most promising technologies for enabling interoperability?

A: Promising technologies include atomic swaps, optimistic rollups, ZK-rollups, and various types of cross-chain bridges.

Q: How does interoperability benefit the average blockchain user?

A: Interoperability can lower transaction fees, increase transaction speeds, and provide access to a wider range of De Fi applications and assets.

Q: What are the potential risks associated with using cross-chain bridges?

A: Potential risks include smart contract vulnerabilities, bridge hacks, and impermanent loss in liquidity pools.

Conclusion of The Future of Interoperability Between Layer 1 & Layer 2 Networks

The future of interoperability between Layer 1 and Layer 2 networks is bright, but it requires continued innovation and collaboration. By addressing the existing challenges and embracing new technologies, we can build a more connected and efficient blockchain ecosystem that benefits everyone. The journey towards seamless cross-chain communication is ongoing, but the potential rewards are immense.